Why Alternative Investments?

The world of investing is changing.

Traditional approaches alone often struggle to keep pace with today’s dynamic markets.

Explore alternative investments like real estate, private equity, and non-traditional asset classes that diversify portfolios and reduce stock market volatility risks.

What Is Driving This Shift?

Alternative investments may offer more than just diversification. Institutional investors increasingly turn to alternative investments for their potential to deliver consistent returns, even during periods of market volatility.

They can provide access to unique, income-oriented strategies and enhanced risk-adjusted returns that traditional markets may not deliver. However, they carry their own unique challenges, including illiquidity and lack of secondary markets.

By gaining exposure to carefully curated offerings, which include rigorous due diligence, diversification strategies, and alignment with risk tolerance levels, investors may better balance potential rewards with inherent risks, aligning their portfolios with long-term financial goals.

Growing Allocations to Alternative Investments

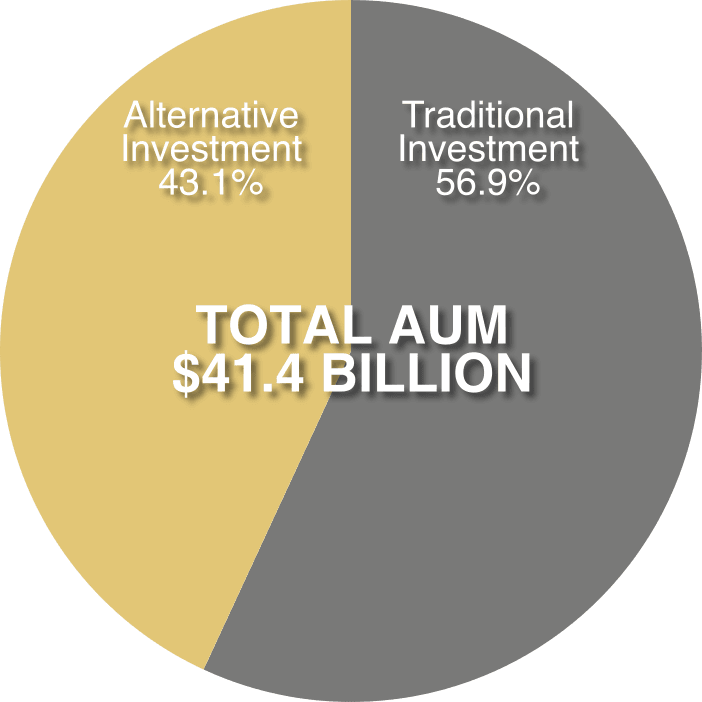

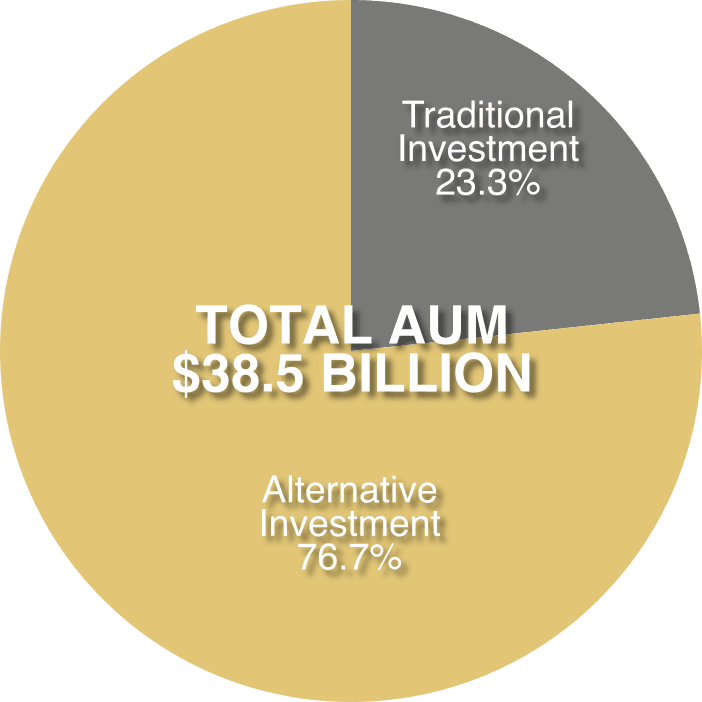

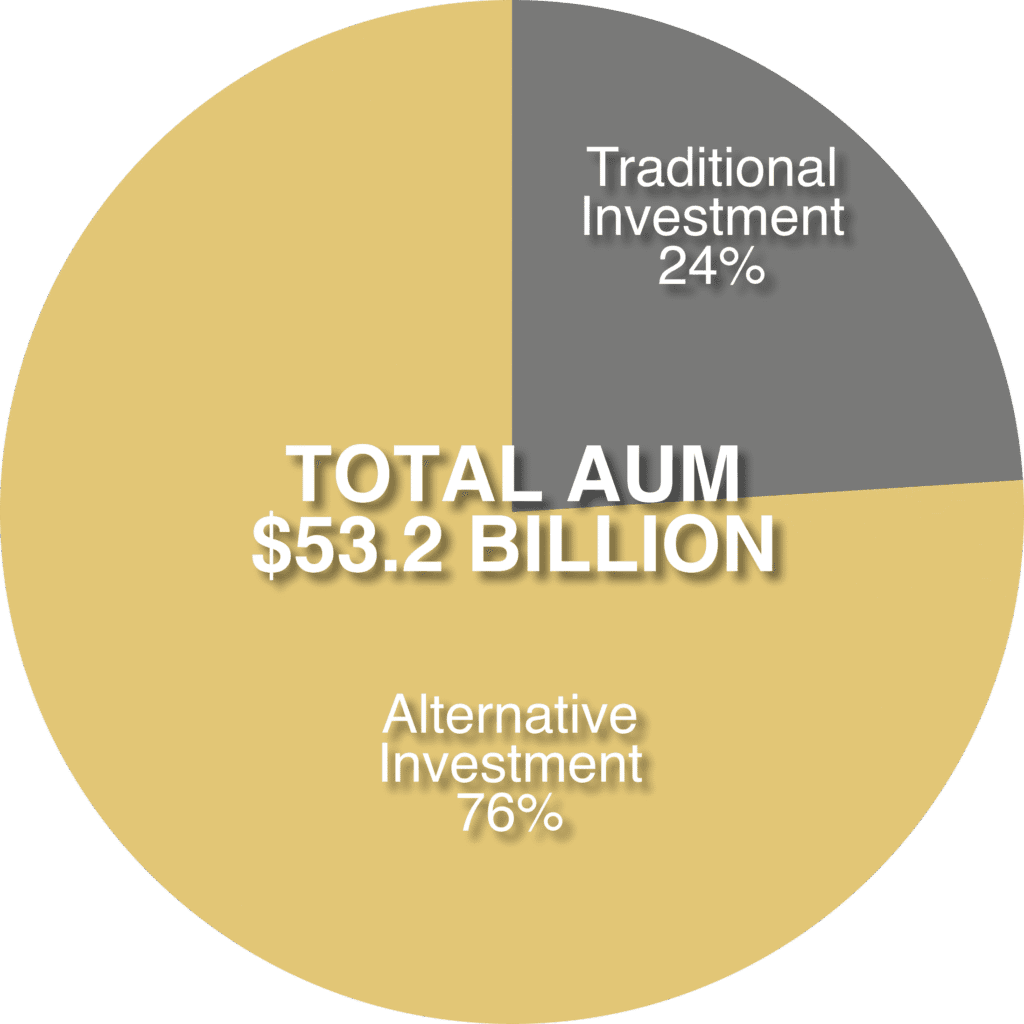

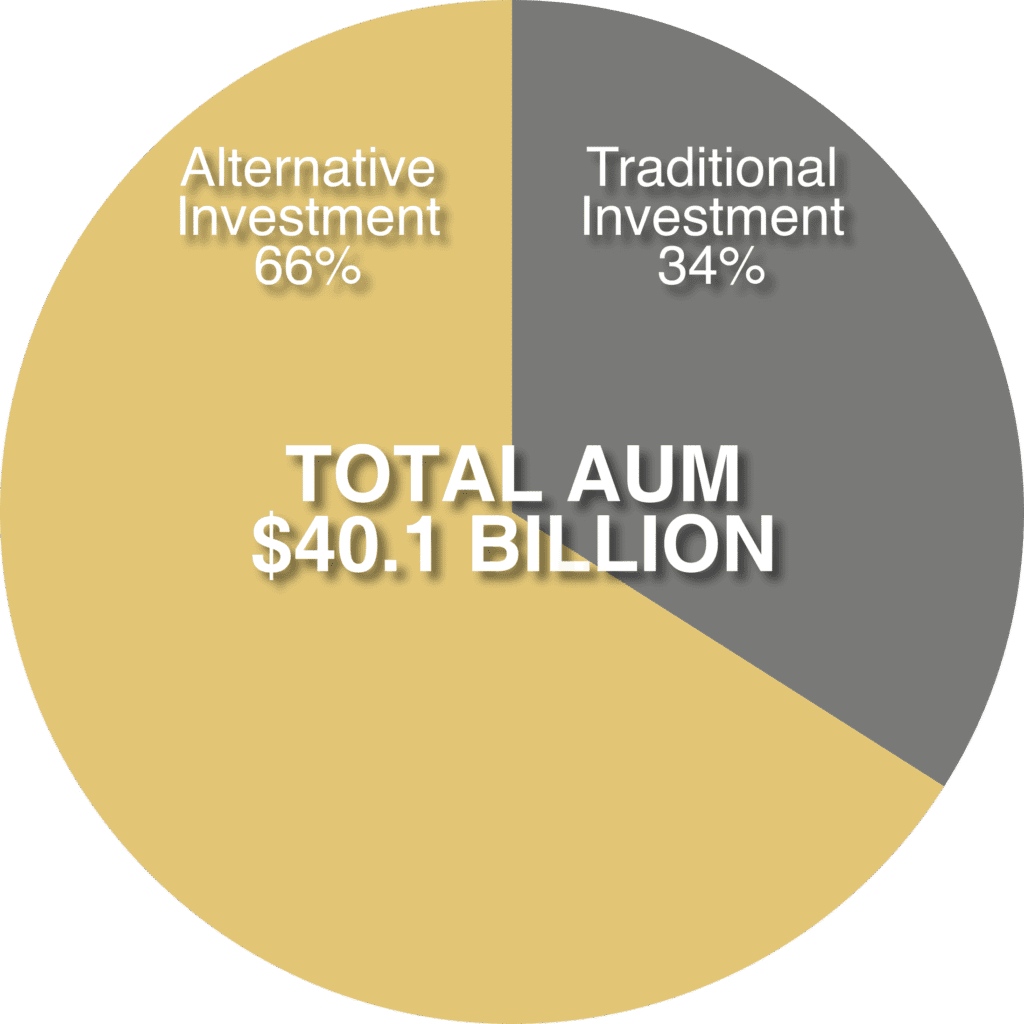

Building on the growing shift toward alternative investments, institutions are increasingly making these strategies central to their portfolios. With renowned university endowments and financial powerhouses leading the way, alternative investments are recognized for their ability to enhance portfolio growth and diversification.

Yale University

Princeton University

*Source:

Harvard University

Stanford University

Brookfield Asset Management

Apollo Global Management

Note: Institutional investment strategies may not align with individual investor objectives or risk tolerance. Consult your advisors before making investments.

Barriers to Unlocking Opportunities

Many investors are generally being excluded from private market offerings due to high investment minimum, or not having the time and expertise to conduct thorough due diligence on these offerings.

Lack of Access

The most compelling opportunities are typically reserved for exclusive networks.

High Entry Barriers

Investment minimums historically set at 1 million* and over.

Complexity in Due Diligence

Evaluating alternative investments often requires significant expertise.

Delivering Solutions

Gain Access

Invest in high-quality non-traditional opportunities, including secured bonds, private equity, and income- generating funds.

Lowered Minimum

Lower entry thresholds to provide broader access to quality investments.

Rigorous Due Diligence

Every opportunity undergoes extensive review, including market analysis, sponsor assessment, and independent evaluations.

Frequently Asked Questions

What is the investment process?

Our investment process are as follows:

- Complete STGM onboarding package.

- Once relationship is established, investor will gain access to offerings from an assigned STGM representative.

- Review the offering documents that fits your investment objective.

- Complete the subscription agreement.

- Fund the investment directly with the issuer (STGM never touches your money).

What are the fees and costs?

All the fees in the offering are listed in the memorandum. STGM does not separately charge investors a brokerage fee.

What are the tax implications or considerations I should know about?

Investors must complete a W-9 form along with the subscription document, or a W-8BEN form for foreign investors. The most common tax forms issued are 1099 or K-1. Some investments allow for tax deferral or deductions. STGM does not provide legal, tax or accounting advice. This information is provided for informational purposes only and is not intended to provide tax advice. You should consult with your tax professional prior to acting on the information set forth herein.

How do I monitor my investments?

The issuer or custodian of your investment will provide options (online portal, email, or mail) for accessing your monthly or quarterly statements. It will also provide end-of-year tax forms.

Why Choose Us?

ST Global Markets USA

specializes in overcoming these challenges by:

Connecting institutional and accredited investors to carefully vetted private placements in alternative asset classes.

Backed by deep industry expertise and strategic issuer partnerships, we align opportunities with your investment objectives.